The Best Guide To Best Bankruptcy Attorney Tulsa

Table of ContentsBankruptcy Attorney Tulsa - An Overview5 Simple Techniques For Tulsa Debt Relief AttorneyThe Greatest Guide To Affordable Bankruptcy Lawyer TulsaRumored Buzz on Which Type Of Bankruptcy Should You FileMore About Tulsa Ok Bankruptcy Attorney

The statistics for the various other major kind, Chapter 13, are also worse for pro se filers. (We damage down the differences in between the 2 key ins depth below.) Suffice it to state, speak to a legal representative or more near you who's experienced with insolvency regulation. Right here are a few sources to locate them: It's reasonable that you could be hesitant to spend for an attorney when you're currently under substantial monetary stress.Numerous lawyers additionally use cost-free consultations or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is indeed the ideal choice for your circumstance and whether they assume you'll certify.

Advertisements by Cash. We might be compensated if you click this ad. Ad Since you have actually made a decision personal bankruptcy is certainly the appropriate strategy and you with any luck removed it with a lawyer you'll need to get going on the paperwork. Before you study all the official bankruptcy forms, you should obtain your very own documents in order.

The Best Strategy To Use For Bankruptcy Lawyer Tulsa

Later on down the line, you'll really need to verify that by disclosing all type of information concerning your financial events. Below's a standard listing of what you'll require on the roadway in advance: Determining papers like your copyright and Social Safety card Tax obligation returns (up to the past four years) Proof of income (pay stubs, W-2s, independent incomes, revenue from properties as well as any kind of revenue from government benefits) Financial institution statements and/or pension declarations Evidence of worth of your assets, such as lorry and realty assessment.

You'll desire to understand what kind of financial debt you're trying to deal with.

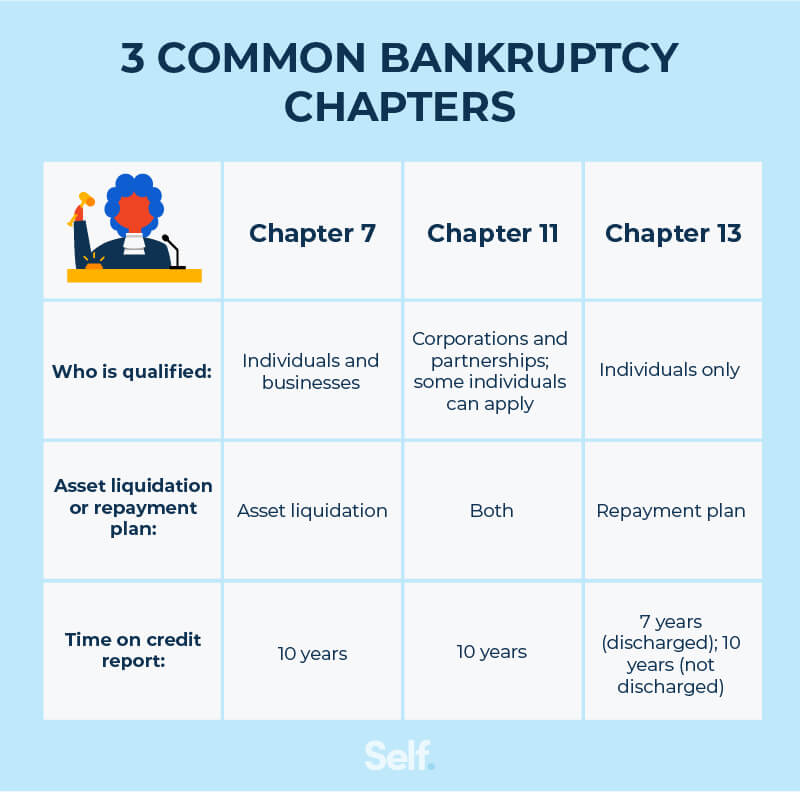

You'll desire to understand what kind of financial debt you're trying to deal with.If your earnings is expensive, you have an additional choice: Chapter 13. This option takes longer to settle your financial obligations due to the fact that it calls for a long-lasting repayment check out the post right here strategy typically 3 to 5 years before some of your staying financial debts are wiped away. The declaring procedure is also a great deal more complex than Phase 7.

The Best Guide To Chapter 7 - Bankruptcy Basics

A Chapter 7 personal bankruptcy remains on your credit rating record for 10 years, whereas a Phase 13 personal bankruptcy falls off after 7. Before you send your insolvency types, you have to initially complete a mandatory training course from a credit history therapy company that has been authorized by the Division of Justice (with the significant exception of filers in Alabama or North Carolina).

The program can be finished online, in person or over the phone. You should finish the course within 180 days of filing for personal bankruptcy.

Get This Report on Chapter 7 Vs Chapter 13 Bankruptcy

Inspect that you're submitting with the appropriate one based on where you live. If your long-term residence has relocated within 180 days of filling, you must file in the district where you lived the greater part of that 180-day duration.

Generally, your personal bankruptcy attorney will function with the trustee, but you may require to send the person files site web such as pay stubs, tax obligation returns, and financial institution account and credit history card statements directly. A common misunderstanding with personal bankruptcy is that when you submit, you can stop paying your financial obligations. While bankruptcy can assist you clean out many of your unsafe financial debts, such as past due clinical costs or individual lendings, you'll desire to maintain paying your month-to-month repayments for guaranteed debts if you desire to maintain the building.

How Which Type Of Bankruptcy Should You File can Save You Time, Stress, and Money.

If you go to risk of repossession and have actually worn down all other financial-relief options, then declaring Phase 13 might postpone the repossession and conserve your home. Ultimately, you will still need the earnings to proceed making future mortgage settlements, in addition to settling any late repayments over the course of your layaway plan.

If so, you might be called for to provide added information. The audit might postpone any debt alleviation by several weeks. Certainly, if the audit shows up incorrect information, your case can be disregarded. All that claimed, these are relatively unusual instances. That you made it this far while doing so is a suitable sign a minimum of a few of your debts are eligible for discharge.